Institutional Crypto Adoption in 2025: A Comprehensive Overview

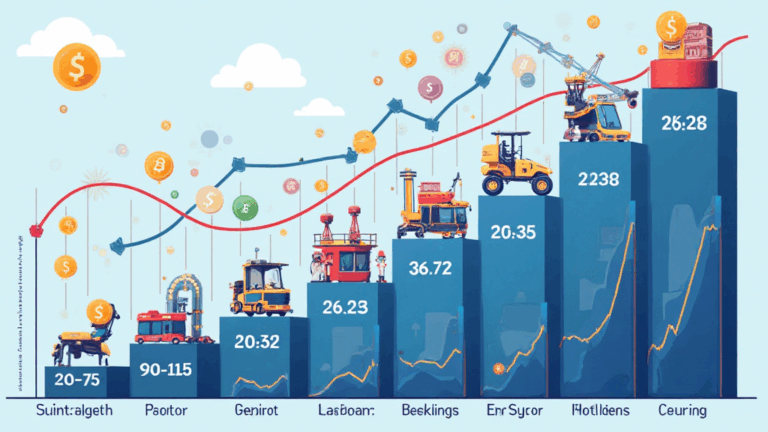

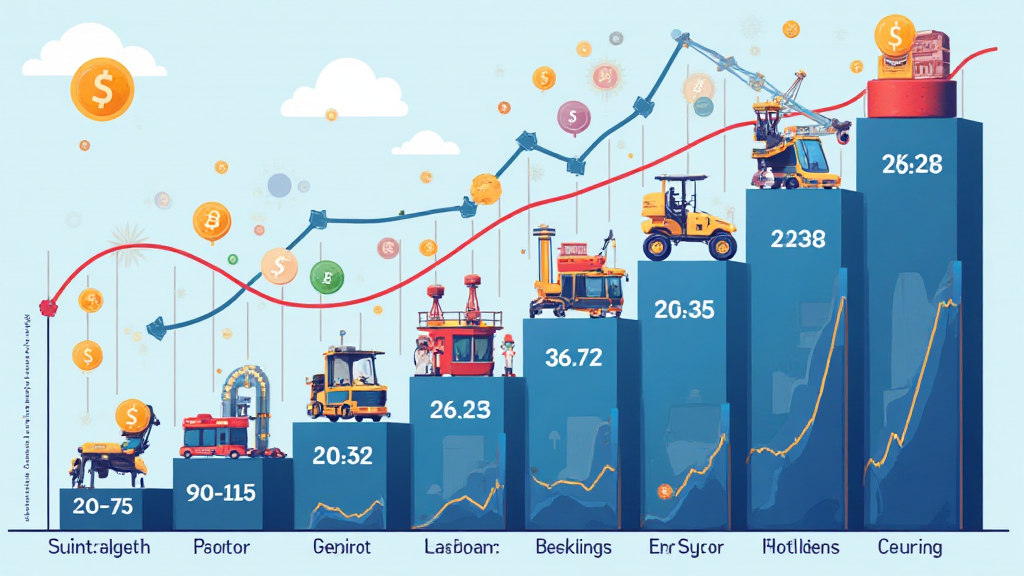

As we traverse the landscape of cryptocurrency in 2023, we’re faced with an intriguing question: How will institutional crypto adoption evolve by 2025? According to a recent study by hibt.com, the crypto market has been witnessing unprecedented levels of institutional interest, leading to a projected 19% CAGR growth over the next two years. This staggering figure underlines the potential for a massive shift in how cryptocurrencies are perceived and utilized within traditional financial frameworks.

The push for widespread adoption among institutional investors isn’t just about trading assets; it’s about integrating blockchain technology into operational infrastructures, enhancing security standards like tiêu chuẩn an ninh blockchain, and ultimately paving the way for regulatory frameworks that can support these advancements.

This article delves into various facets of institutional crypto adoption as we approach 2025, shedding light on trends, challenges, and what sets the stage for a resilient crypto ecosystem.

The Current State of Crypto Adoption

The narrative surrounding crypto adoption has evolved significantly over the past few years. In 2024 alone, institutional investment in cryptocurrencies surged by 260%, with a notable influx of investments from hedge funds, private equity firms, and family offices. By 2025, we expect this trend to accelerate further. But what drives this momentum?

- Regulatory Clarity: As governments become more involved in crypto regulation, institutional players are more willing to enter the market.

- Technological Advancements: Enhanced blockchain technologies, including Layer 2 solutions and less volatile digital assets, are making crypto more appealing to traditional investors.

- Diversification Strategies: With a volatile economic environment, crypto assets provide a unique avenue for diversification.

Key Trends Shaping 2025’s Institutional Adoption

Several trends are crucial as we look towards 2025:

- Integral Role of Blockchain: Institutions are beginning to leverage blockchain not only for trading but also for enhancing transparency and traceability in financial transactions.

- Integration with Traditional Finance: The blending of DeFi with banking services is set to gain traction, demonstrated by the rise of decentralized autonomous organizations (DAOs).

- Focus on Security: As more assets are placed in digital form, safeguarding these becomes paramount. Enhanced security measures like tiêu chuẩn an ninh blockchain will be adopted.

Challenges to Overcome

Despite the promising outlook, institutional crypto adoption faces significant challenges:

- Market Volatility: The unpredictability of cryptocurrency prices remains a deterrent for some institutional investors.

- Regulatory Frameworks: The absence of clear regulations can lead to uncertainty, impacting institutional entry.

- Technological Gaps: Institutions must address their tech capabilities and understanding of blockchain technology.

Strategies for Successful Integration

Institutions looking to adopt cryptocurrencies can adopt several strategies:

- Education and Training: Investing in staff training about blockchain technology can foster a culture of innovation.

- Partnerships with Crypto Experts: Collaborating with platforms like padcoinc can provide necessary expertise and insight into the rapidly changing market.

- Security Investment: Employing advanced security measures and compliance checks is crucial to protect assets.

The Role of Vietnam in Global Adoption

Vietnam demonstrates a unique case for observing crypto adoption trends. The country has seen a 240% increase in crypto ownership among its citizens since 2022. This local growth indicates a budding interest in digital currencies among Vietnamese investors.

Vietnam’s government is also evaluating its regulatory stance towards cryptocurrencies, suggesting that institutional adoption could be just around the corner. With localized efforts for education about tiêu chuẩn an ninh blockchain, institutions may soon find their footing in the crypto space, paving the way for an inclusive financial ecosystem.

Looking Ahead: Predictions for 2025

By 2025, the landscape of institutional crypto adoption could look drastically different. Here are some predictions:

- Increased M&A Activity: We may see more mergers and acquisitions between traditional financial institutions and blockchain firms, merging expertise.

- Mainstream Financial Products: Crypto-based ETFs or mutual funds might be a common offering among major financial services.

- Wider Acceptance: Expect to see more mainstream consumer adoption of cryptocurrencies, driven by institutional validation.

Conclusion

In summary, the path towards institutional crypto adoption by 2025 is filled with both opportunities and challenges. As more institutions begin to understand the necessity of integrating digital assets into their portfolios, they will need to navigate the complexities of regulations, market behaviors, and technological advancements. Vietnam’s emerging role in this landscape could serve as a catalyst for similar markets, showcasing the potential for blockchain solutions in areas like finance and security.

Institutional crypto adoption is accelerating, fueled by a combination of market demand and technological innovation. To stay ahead of the game, organizations must prepare to adapt and innovate.

For those looking to deepen their understanding and prepare for these changes, visiting platforms like padcoinc is vital. They provide various resources and insights into navigating the evolving world of cryptocurrencies.

Author: Dr. Alex Thompson, a blockchain expert with over 15 published papers, and an advisor for several high-profile projects. His expertise lies in the intersection of finance and technology, making him a trusted voice in the realm of crypto.