Introduction

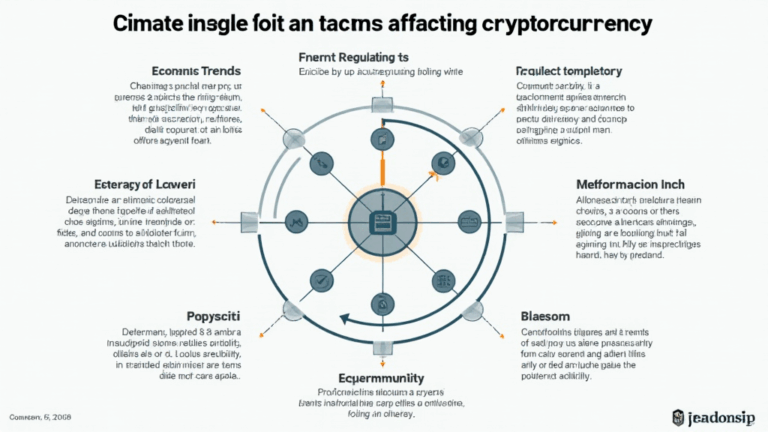

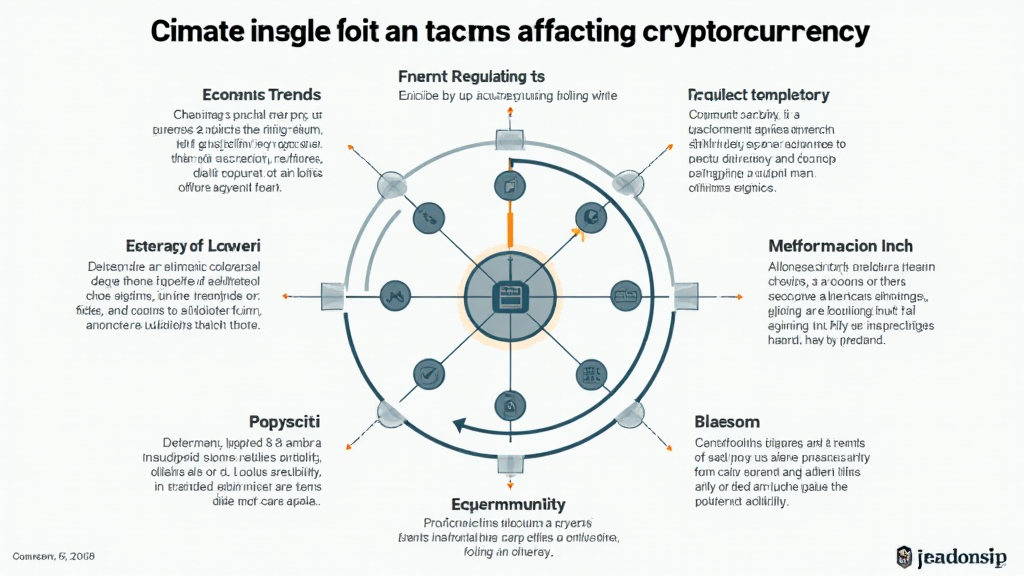

With $4.1B lost to DeFi hacks in 2024, understanding macro factors affecting crypto has never been more crucial. In a market that continues to evolve rapidly, it is imperative to analyze variables such as economic trends, regulatory changes, and technological advancements that shape the landscape of digital currencies. This article aims to unpack these elements in a way that highlights their impact on the cryptocurrency scene and offers valuable insights for investors and enthusiasts alike.

The Economic Landscape and Its Impact on Crypto

Economic factors significantly influence the cryptocurrency market. Global recessions, inflation rates, and interest rates play pivotal roles.

Global Recession Trends

The potential for a global recession can create financial uncertainty, pushing investors towards alternative assets like cryptocurrencies. For instance, during economic downturns, Bitcoin and stablecoins often serve as hedge instruments.

The Role of Inflation

As inflation rises, individuals may turn to cryptocurrencies to preserve wealth. Countries experiencing hyperinflation see increased crypto adoption, with user growth in Vietnam showing an annual increase of 40% in 2024 alone.

Interest Rates and Investment Flow

With central banks adjusting interest rates, the capital flow into crypto can vary. Lower interest rates generally encourage borrowing and investment in riskier assets like digital currencies.

Technological Innovations Shaping Crypto Markets

Advancements in blockchain technology revolutionize the crypto landscape.

Smart Contracts and Their Auditability

Understanding how to audit smart contracts is vital. Smart contracts automate transaction processes, but their vulnerabilities can lead to significant losses.

The Rise of Decentralized Finance (DeFi)

DeFi platforms are reshaping how we perceive traditional financial services, enabling users to lend, borrow, and trade without intermediaries.

Blockchain Security Standards

The emergence of security standards like “tiêu chuẩn an ninh blockchain” in Vietnam signifies the need for regulations, promoting user confidence and innovation.

The Regulatory Environment and Its Implications

Changes in regulations can have profound impacts on the market.

Government Regulations on Cryptocurrency

Countries worldwide are experimenting with crypto regulations. In Vietnam, the government’s stance on crypto is pivotal—offering both risks and opportunities for investors.

Taxation Policies Affecting Investors

Understanding local taxation policies is essential for investors. Increased compliance could deter speculative investments, affecting market volatility.

The Influence of Social Media and Sentiment Analysis

Social sentiment plays a crucial role in crypto price movements.

Social Media Buzz and Market Trends

Platforms like Twitter and Reddit can create waves of buying or selling pressure, demonstrating how quickly sentiment shifts can affect market prices.

Influencers and Their Impact

Key influencers in the crypto space can amplify market trends, affecting user adoption rates and investing behaviors.

Conclusion

In 2025, the macro factors affecting crypto remain vast and varied—ranging from economic climate to technological developments and regulatory frameworks. Understanding these factors will prove pivotal for anyone engaging in the crypto space. It’s evident that as the world adapts to cryptocurrencies, informed strategies will become a key component of successful investing. For more insights, stay connected with padcoinc, where crypto knowledge meets innovation.