Introduction

With the ever-evolving landscape of cryptocurrency investments, understanding the current trends and price movements is more crucial than ever. Today, December 21, we dive into an analysis of BNB, Binance’s native token, amidst shifting market conditions. Did you know that in 2024, the overall cryptocurrency market saw a decline of $4.1 billion due to various factors, including a significant amount lost to DeFi hacks? We aim to provide insights on BNB’s performance, factors affecting its price, and forecasts for the upcoming months.

Understanding BNB: A Brief Overview

BNB (Binance Coin) is a utility token created by Binance for use on its trading platform. Initially launched as an ERC-20 token, it later migrated to its own blockchain, the Binance Chain. BNB allows users to pay trading fees on Binance with discounts and also serves as a medium of exchange on Binance Smart Chain (BSC), which has gained traction in the decentralized finance (DeFi) sector.

As of now, BNB is influential not just on Binance but also in the global cryptocurrency ecosystem. Its price movements often reflect broader market trends, therefore closely monitoring its price becomes essential for crypto investors and enthusiasts.

Current Market Overview

As we analyze BNB today, it is pivotal to look at the broader market context. According to recent data from CoinMarketCap, the major elements influencing the price of BNB include:

- The popularity and usage rate of Binance exchanges in various regions, especially in Southeast Asia.

- Market sentiment and speculative trading, which have been robust in the Vietnam market.

- Technological developments within the Binance ecosystem affecting usability and trading efficiency.

Recent statistics show that the user growth rate in Vietnam is nearing 27% year on year, showcasing an increasing penetration of crypto among Vietnamese investors.

Factors Influencing BNB Price Today

To fully grasp the BNB price analysis today, we must consider several critical factors:

- Regulations: The legal landscape surrounding cryptocurrencies is a crucial factor for BNB. Recent regulations may impact the price as governments worldwide clarify their stances on digital assets.

- Market Trends: The current bullish sentiment exhibited by Bitcoin could reflect positively on BNB, as historically, altcoins tend to follow Bitcoin’s lead.

- Project Developments: Ongoing improvements and new integrations within the Binance ecosystem can enhance the utility of BNB, influencing potential price increases.

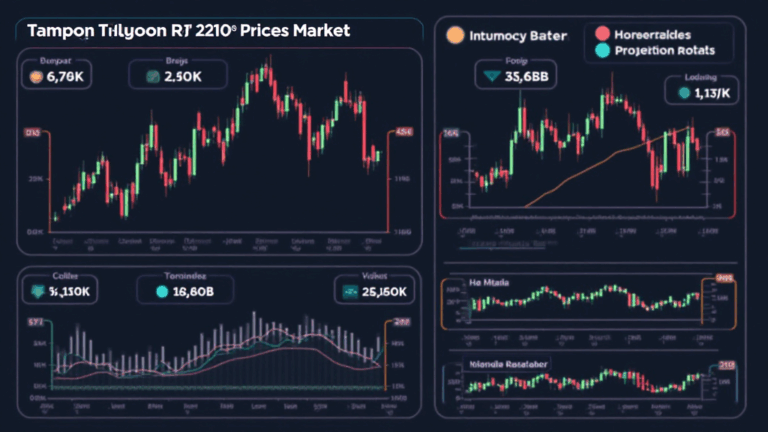

Technical Analysis of BNB

Implementing technical analysis for BNB gives us deeper insights into potential future price movements. Current charts display the following patterns:

- Support Levels: For traders, identifying robust support levels around $200 is critical for investment decisions.

- Resistance Levels: Current resistance appears near the $250 mark, suggesting sellers might emerge if BNB approaches this price.

Latest technical indicators, such as Moving Averages and RSI (Relative Strength Index), show BNB hovering near neutral territory, indicating neither overbought nor oversold conditions, which could suggest stability in the short term.

Long-term Prospects for BNB

Looking ahead, it’s vital to set expectations for BNB’s price trajectory. Various analysts predict differing outcomes based on market variables. Long-term investors often search for potential in:

- Sustainability: The Binance Smart Chain’s growth will significantly affect BNB utility and thus its price. Institutions looking at DApps and smart contracts are likely to impact BNB’s performance positively.

- Investment Trends in Southeast Asia: Considering the rising number of crypto enthusiasts in Vietnam and neighboring countries contributes to positive sentiment around BNB.

Conclusion

In conclusion, today’s BNB price analysis on December 21 reveals a multifaceted picture. While the underlying technology is robust and supported by vast user growth, external factors such as regulations and market trends should be continually assessed. The potential for BNB in Southeast Asia is particularly encouraging, aided by the region’s increasing adoption rates.

If you’re considering investing, remember that crypto assets like BNB come with risks and any investment decisions should be made prudently. Consulting with financial professionals and following developments closely will be key to navigating this vibrant ecosystem. For more detailed coverage and future updates, feel free to visit hibt.com.

Stay tuned for more insights on BNB price analysis as we look forward to potential developments in the coming weeks. Remember that this information is for educational purposes and not financial advice. Always consult local regulators before making any investments.

Author: Dr. Robert Nguyen, a financial analyst and crypto enthusiast, has published over 20 papers in various financial journals and led several high-profile audits in blockchain projects.