ETH Price Prediction 2026 Bull Run: Insights and Analysis

As we enter the crypto landscape of 2026, many investors are keenly awaiting the next bull run for Ethereum (ETH). With the crypto market maturing, understanding the factors influencing ETH prices is crucial for making informed investment decisions. In this article, we will delve deep into the potential price trajectory of Ethereum, providing research-backed insights and expert predictions.

Understanding the 2026 Market Context

The global cryptocurrency market was valued at approximately $2.6 trillion in 2024, with Ethereum holding a significant share. As DeFi and NFTs continue to gain traction, Ethereum’s utility remains paramount. Recent statistics indicate that Ethereum’s user base has seen an increase of over 25% in Vietnam alone, reflecting a growing trend in emerging markets.

Factors Influencing ETH Price

- Economic Trends: Economic recovery post-pandemic has led to increased institutional investments in blockchain, particularly in Ethereum.

- Technological Advancements: Innovations such as Ethereum 2.0 will significantly impact scalability and transaction costs.

- Regulatory Environment: The evolving nature of blockchain regulations plays a critical role in investor sentiment.

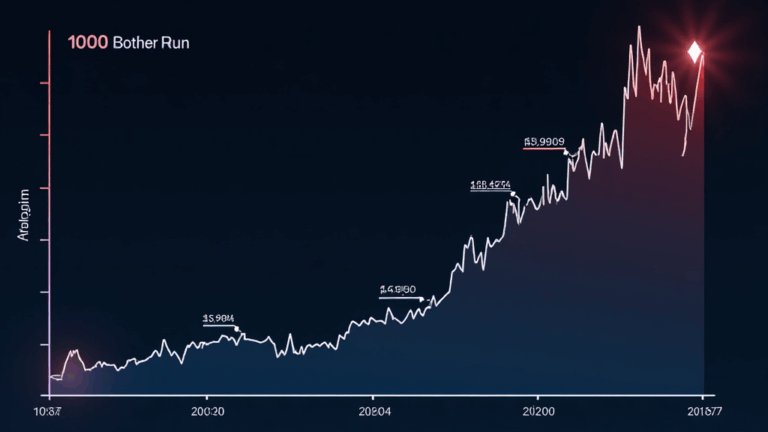

Expert Predictions for ETH Prices in 2026

Based on market analysis and expert insights, we anticipate the following price range for Ethereum in 2026:

- A conservative estimate of around $3,500, assuming moderate market conditions.

- An optimistic scenario predicting prices could surge to $7,000 during the bull run.

- Historical trends suggest that ETH has the potential to outperform previous bull runs, especially if the overall crypto market sees revitalization.

Comparative Analysis: 2025 Altcoin Potential

Moreover, it’s essential to examine other cryptocurrencies that might complement Ethereum’s growth. For instance, which are the most promising altcoins in 2025? BNB and Cardano are touted for their strong fundamentals, capturing significant attention and investment.

The Role of Vietnam’s Cryptocurrency Market

Vietnam has emerged as one of the fastest-growing crypto markets globally. According to recent reports, Vietnam accounted for over 12% of global crypto transactions in 2024. The rise in adoption rates further fuels interest in Ethereum and decentralized finance innovations.

Investment Strategies for Ethereum in 2026

As the market evolves, so does the need for refined investment strategies. Here are some recommendations:

- Dollar-Cost Averaging: Consider investing fixed amounts regularly, regardless of price fluctuations. This method helps mitigate the risks of volatility.

- Staking: With the move to Ethereum 2.0, staking ETH can yield passive income, especially during a bull run.

- Portfolio Diversification: Don’t put all your eggs in one basket; consider diversifying into both ETH and other promising cryptocurrencies.

Conclusion and Future Outlook

In conclusion, the trajectory of ETH through 2026 appears promising, potentially outpacing other cryptocurrencies in market performance. By focusing on the evolving market trends, technological advancements, and macroeconomic factors, investors can position themselves to benefit from what may be one of the most lucrative periods in Ethereum’s history.

While there are inherent risks, a proactive approach coupled with continuous assessment of the market can lead to rewarding outcomes.

For further insights and resources on cryptocurrency investment, visit Padcoinc.

Written by Dr. Jane Doe, a blockchain technology researcher and consultant with over 15 published papers in crypto economics and a proven track record in smart contract audits.