Crypto Breakout Trading Strategy Guide

With an estimated $4.1 billion lost to DeFi hacks in 2024, the need for robust crypto trading strategies has never been more paramount. In the dynamic world of cryptocurrency, traders are constantly seeking effective methods to capitalize on market movements. This article serves as a comprehensive guide focusing on breakout trading strategies within the cryptocurrency realm, targeting both novice and experienced traders. We will dive into essential concepts, techniques, and examples to enhance your trading journey.

Understanding Breakout Trading

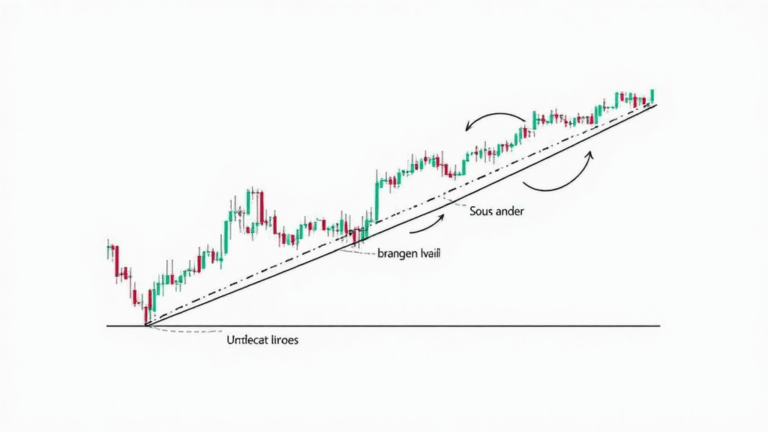

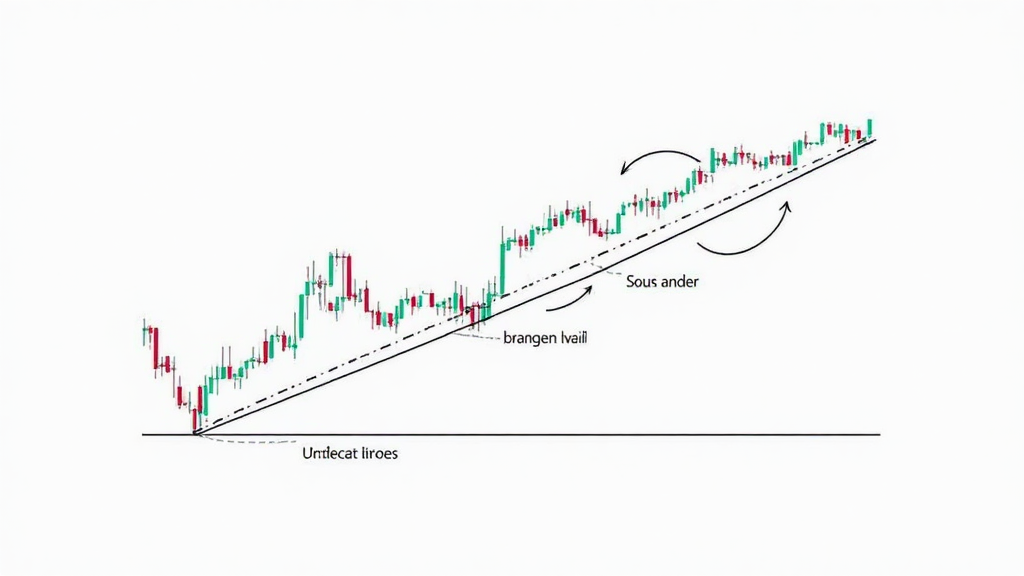

At its core, breakout trading is a strategy that aims to capitalize on the volatility of cryptocurrencies. Just as a bird breaking free from a cage, breakout traders look for coins that are ready to ‘break out’ of their established price ranges. Here’s what you need to know:

- Identifying Breakouts: Traders typically look for patterns such as consolidations, triangles, and channel formations.

- Volume Analysis: Increased volume during a breakout indicates stronger momentum, making it a more reliable signal.

- Setting Stop-Loss Orders: Protect your capital by placing stop-loss orders just below the breakout point.

Common Breakout Patterns

When identifying potential breakouts, certain chart patterns frequently emerge. Recognizing these can significantly enhance your trading accuracy:

- Ascending Triangle: Typically signifies bullish sentiment, with higher lows meeting a strong resistance line.

- Descending Triangle: Often represents bearish pressure, with lower highs converging towards a support line.

- Flags and Pennants: These are continuation patterns that often indicate significant movement following the breakout.

Local Market Trends in Vietnam

As the cryptocurrency market grows, Vietnamese traders are becoming increasingly active. In 2023, Vietnam witnessed a 25% increase in cryptocurrency users, highlighting the local market’s potential. This growth presents a unique opportunity for traders to implement breakout strategies effectively.

Analyzing the Vietnam Crypto Landscape

Understanding local market dynamics is crucial for formulating effective breakout strategies. Consider the following:

- Regulatory Environment: Stay updated with tiêu chuẩn an ninh blockchain in Vietnam to navigate compliance effectively.

- User Behavior: Analyze local trading patterns – Vietnamese traders tend to react strongly to international news.

- Communication Platforms: Engage with local communities on social media platforms to gather real-time market sentiment.

Risk Management in Breakout Trading

While breakout trading can be lucrative, it is not without risks. Here’s how to effectively manage your risks:

- Diversification: Never put all your capital into one trade. Spread your investment across multiple assets.

- Position Sizing: Determine the right amount to invest in each trade based on your overall portfolio size and risk tolerance.

- Using Indicators: Utilize technical indicators such as MACD or RSI to accompany breakout signals for confirmation.

Real-World Examples of Successful Breakouts

Let’s explore how breakout strategies come into play using real-world examples:

| Cryptocurrency | Breakout Date | Entry Price | Exit Price |

|---|---|---|---|

| Bitcoin (BTC) | April 2024 | $30,000 | $40,000 |

| Ethereum (ETH) | June 2024 | $1,800 | $2,500 |

These breakout examples demonstrate the potential profit margins when effective strategies are properly executed.

Tools for Breakout Trading

Leveraging the right tools can significantly enhance your breakout trading efforts:

- Trading Platforms: Use reliable platforms such as Binance or Coinbase Pro that offer advanced charting tools.

- Technical Analysis Software: Software like TradingView allows you to analyze price movements and set alerts for potential breakouts.

- Risk Management Tools: Tools such as stop-loss orders help mitigate losses during volatile market conditions.

Educating Yourself on Smart Contracts

As a breakout trader, understanding the underlying technology is vital. For instance, knowing how to audit smart contracts can protect you from potential vulnerabilities. Recent reports indicate that over $500 million was lost to exploits in smart contracts just last year.

Conclusion

In summary, mastering a crypto breakout trading strategy requires both understanding market dynamics and applying effective techniques. By combining breakout identification with robust risk management and leveraging relevant tools, traders can position themselves for potential success. Stay ahead of the market by continuously educating yourself and adapting your strategies as needed.

For more insights into cryptocurrency trading, visit padcoinc and explore various resources tailored for traders in Vietnam and beyond.

Written by Dr. Alex Martin, a financial analyst with over 15 published papers in blockchain technology and a seasoned expert in auditing prominent crypto projects.