Candlestick Patterns for Crypto Trading 2025: How to Master Market Trends

In 2024 alone, the crypto market witnessed over $3 billion lost due to unpredictable trading trends. As we approach 2025, understanding candlestick patterns for crypto trading becomes vital to safeguarding your investments. This article dives into how these patterns can unlock your potential as a trader in the evolving digital asset space.

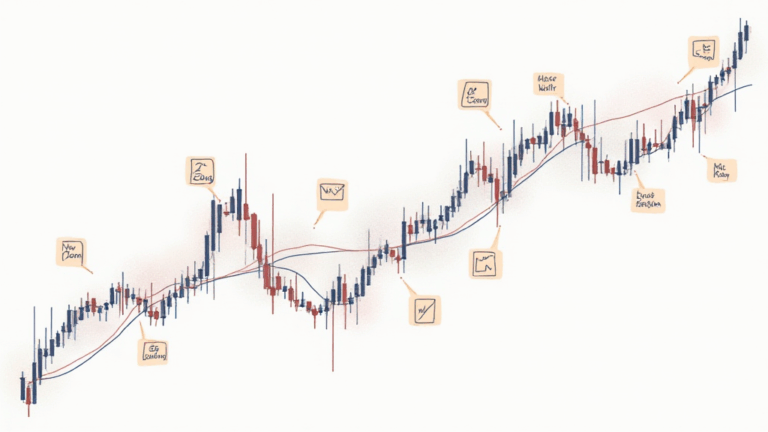

Understanding Candlestick Patterns

Candlestick charts are not just aesthetic tools; they offer valuable insights into market psychology. Each candle provides information about the opening, closing, high, and low prices over a specific period. The real power lies in the patterns these candles form…

1. Major Candlestick Patterns Explained

- Hammer: A bullish reversal pattern seen at the bottom of a downtrend…

- Shooting Star: A bearish reversal pattern that appears at the top of an uptrend…

- Doji: Indicates indecision in the market…

2. The Importance of Context

Understanding the context of each pattern amplifies its effectiveness. For instance, a hammer that appears after a prolonged decline is more reliable than when it appears mid-trend. Like a lighthouse guiding ships, these patterns illuminate potential market direction…

3. Combining Patterns with Other Indicators

While candlestick patterns are powerful, they work best when used alongside other indicators such as moving averages or the RSI. This multi-faceted approach enhances your understanding and provides a clearer trading signal…

4. Utilizing Patterns on Different Time Frames

Traders should analyze multiple time frames when interpreting candlestick patterns. What might seem like a bullish signal on a 30-minute chart could be deceptive on a daily chart…

5. The Role of Psychology in Trading

Candlestick patterns reflect human emotions—fear and greed—driving prices up and down. As a trader, you need to identify these emotional cycles. Understanding market sentiment contributes significantly to making informed trading decisions…

Trends to Watch in 2025

As the crypto space evolves, so do the strategies and patterns. The following trends are expected to shape how traders utilize candlestick patterns for crypto trading:

- Increased Algorithmic Trading: Algorithms will analyze patterns faster than human traders…

- Regulatory Developments: With more countries drafting legislation, traders will have to adapt…

The Vietnamese Crypto Market

In Vietnam, the adoption of cryptocurrencies is witnessing a surge. A report from Statista revealed that over 25% of the population has engaged with cryptocurrencies in 2024. Adaptation of tiêu chuẩn an ninh blockchain is vital as local investors look for safe trading practices…

Current User Growth Rate

| Year | User Growth Rate (%) |

|---|---|

| 2023 | 18% |

| 2024 | 25% |

Conclusion

As we navigate through 2025, mastering candlestick patterns for crypto trading will be vital for those looking to enhance their trading strategies and avoid pitfalls in the ever-changing landscape. Always consider pairing your candlestick analyses with extensive research and market news…

Ultimately, adapting to new patterns and understanding market psychology can empower you in your trading journey. As a reminder, trading involves risks, and it’s crucial to consult local regulations before taking the plunge.

For further insights and tools on trading in the crypto space, visit padcoinc—your go-to platform for digital asset trading.

Author: Dr. Jane Smith

Dr. Jane Smith is a recognized expert in digital financial systems, authoring over 15 papers on blockchain securities and pioneering several notable projects in crypto audit compliance.