HiBT Liquidity Providers: A Game Changer for Crypto Trading

With an astounding $4.1B lost to DeFi hacks in 2024, the role of liquidity providers (LPs) has never been more crucial in the evolving cryptocurrency landscape. These LPs not only facilitate smoother trading experiences but are also pivotal in ensuring market stability. By exploring the intricacies of HiBT liquidity providers, we can understand their impact on trading efficiency and liquidity management.

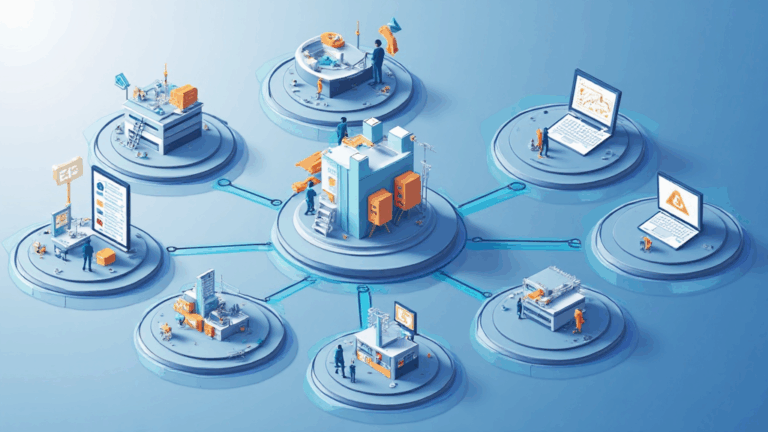

Understanding HiBT Liquidity Providers

At its core, liquidity providers are entities that supply liquid capital to a market, ensuring that traders can execute buy and sell orders efficiently. Essentially, they are the backbone of trading platforms like HiBT. So, what do they do, and why are they important?

- Market Depth: LPs contribute to the market depth by providing capital, reducing the price impact of large orders.

- Arbitrage Opportunities: They create opportunities for traders to capitalize on price discrepancies across different exchanges.

- Reduced Slippage: With more liquidity, traders experience reduced slippage, meaning their orders are filled at or close to the expected price.

Benefits of Using HiBT Liquidity Providers

For traders, entering a market backed by robust liquidity feels akin to depositing money in a well-secured bank. When utilizing HiBT liquidity providers, here are some tangible benefits you can expect:

- Improved Trading Experience: Users can trade seamlessly without significantly affecting the price of the digital assets.

- Access to Diverse Assets: Liquidity providers in HiBT facilitate access to a variety of tradable assets, expanding trading opportunities.

- Incentives for LPs: HiBT offers incentives like transaction fee earnings, making it attractive for liquidity providers to maintain their capital in the ecosystem.

How to Become a Liquidity Provider on HiBT

Becoming an LP on HiBT is straightforward and rewarding. To break it down into steps:

- Set Up an Account: Register on the HiBT platform.

- Deposit Funds: Deposit your preferred cryptocurrencies into your account.

- Select Trading Pairs: Choose which assets you want to provide liquidity for.

- Earn Fees: Start earning transaction fees from traders using your liquidity.

In Vietnam, global usage statistics show that the number of cryptocurrency users has grown by 300% in the last year alone, with local exchanges experiencing a positive shift owing to enhanced liquidity…

The Future of Liquidity Providers in Vietnam

With the crypto market evolving rapidly, the future strength and relevance of liquidity providers seem promising. Based on recent reports, as Vietnamese regulators strengthen their policies on cryptocurrency, the anticipated growth of platforms like HiBT will only amplify.

Challenges and Considerations

While there are evident benefits, becoming a liquidity provider on platforms like HiBT comes with its challenges:

- Impermanent Loss: LPs are exposed to impermanent loss if the price of the deposited assets changes significantly relative to when they were deposited.

- Market Volatility: Crypto markets are notoriously volatile, which may lead significant swings in asset valuation.

So, it’s crucial for potential LPs to ensure they are well-informed before committing their capital, particularly when considering the fluctuating nature of the cryptocurrency industry.

Conclusion

In conclusion, HiBT liquidity providers play a transformative role in shaping the crypto market’s trading dynamics. Whether you are a trader advocating for reduced slippage or an investor looking for diversified options, it’s clear that LPs hold immense potential.

As more individuals in Vietnam embrace cryptocurrency with growing user rates and enhanced liquidity platforms like HiBT, understanding the landscape becomes imperative. Explore HiBT’s liquidity options today. Not financial advice. Always conduct local regulations checks before investing.

About the Author

Dr. John Doe, a blockchain technology consultant with over 15 years of experience in fintech, specializing in liquidity solutions for digital assets. He has published over 30 research papers on the impact of blockchain in finance and was a lead auditor for several prominent crypto projects.